The expense ratio in the context of a Mutual Fund is the expense incurred to manage funds (or a Mutual Fund scheme). This fee is charged by the respective AMC (Asset Management Company).

What is a good expense ratio?

A lower expense ratio is considered beneficial for investors. In nutshell low expenses mean lower costs and higher amounts are allocated for investments.

Furthermore, as the Assets Under Management (AUM) of a mutual fund increases, the expense ratio decreases. As per SEBI regulations, the expense ratio is inversely proportional to the asset size of a scheme.

Expense ratio Formula

There are two main components while calculating the expense ratio in mutual funds:

- Total expense: This expense may include administrative costs, operational cost, marketing cost, promotional costs, compliance costs, maintenance fees, brokerage, distribution cost etc.

- AUM: This is the asset (funds) under management with a particular scheme of the AMC.

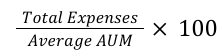

The formula for calculating mutual funds expense ratio (ER) is

Let’s understand this with the help of an example.

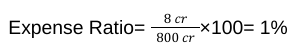

For eg let’s say there is an MF scheme with a corpus of Rs 800 cr. Expenses incurred to manage these funds (Rs 800 Cr) is Rs 8 cr.

In this case:

This 1% expense ratio represents the percentage of the fund’s average net assets that will be used to cover the expenses of the fund.

Look into other costs associated with mutual funds : Cost of Investing in mutual funds

2 प्रतिक्रियाएं