| Regular SIPs | Buying on Dips |

| Monthly/quarterly fixed investments, irrespective of market conditions. | Buy low, sell high based on market fluctuations. |

| Doesn’t require constant market monitoring. | Involves constant market monitoring. |

| Emphasizes the importance of consistent time in the market. | Emphasizes the importance of timing the market accurately. Normally investors and fund managers cannot time the market. |

| Involves very little less time and effort. | Demands significant time and effort for effective execution. |

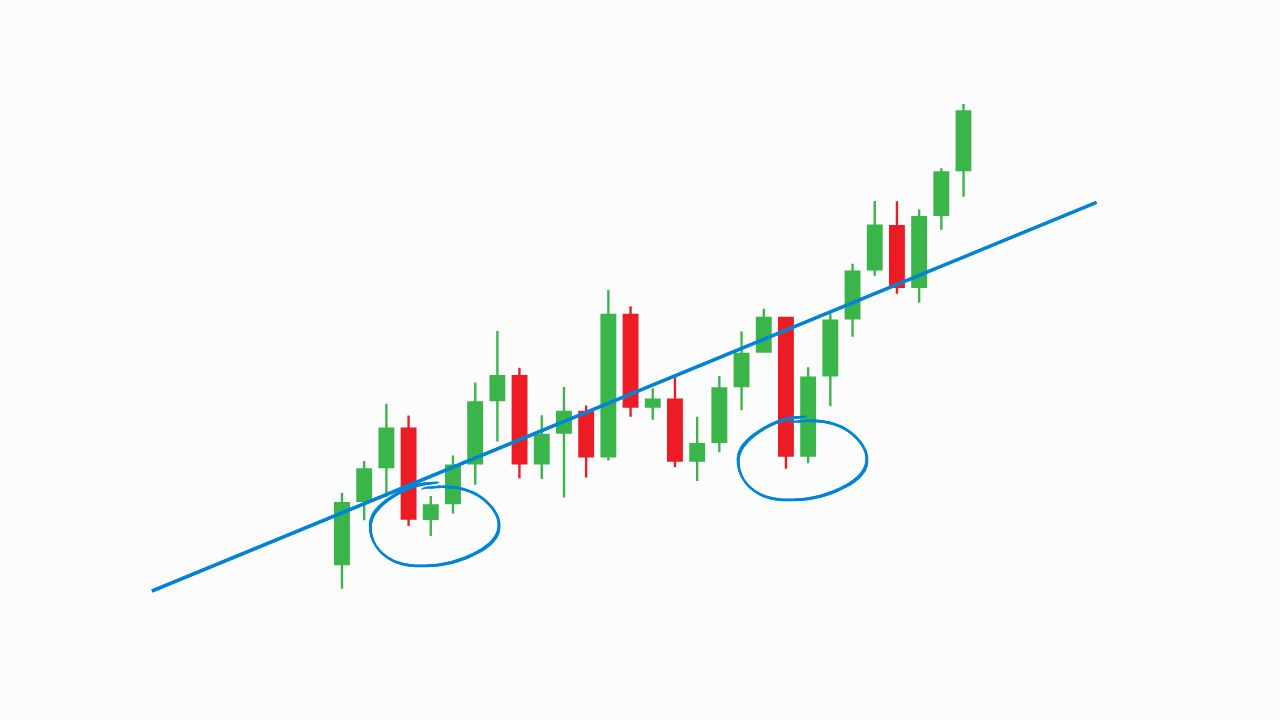

Opting for regular SIPs is a more practical choice compared to attempting to Buying on Dips. It’s nearly impossible to accurately predict whether the market will rise or fall. While predictions are possible, certainty about the future remains elusive.

Speak with our experts to optimize your investments and make informed decisions related to your portfolio.

Taking the example of SpiceJet Stocks: On 20th February 2020, the share price was 92.95 INR. Subsequently, on 6th March 2020, it dropped to 63 INR, leading some investors to consider buying the dip. However, the price further declined to 35.25 INR on 25th March 2020.

Until 20th November 2020, investors experienced significant losses. The stock gradually rose to 106.15 INR on 11th December 2020 but has been on a decline since then. As of 14th February 2024, the share price stands at 62.25 INR.

Identify the strengths and weaknesses in your portfolio based on returns, volatility, asset allocation, and more, enabling you to make informed decisions related to your portfolio.

Review all your mutual Fund Investments in one place with MutualFundWala

In summary, choosing between market timing and regular SIPs depends on preferences and goals. Market timing involves active monitoring and effort, while SIPs offer a more hands-off, consistent approach for long-term investors.

Deciding between Regular SIPs and buying on dips can impact your investment outcomes.

If you’re unsure which strategy best suits your needs or want to explore the advantages of each, contact MutualFundWala today.

Our team is ready to provide tailored support and help you make informed decisions to enhance your investment strategy.