गोल्ड फंड बनाम सॉवरेन गोल्ड बॉन्ड

Basis Gold Fund Sovereign Gold Bonds What The gold mutual fund invests in physical gold or gold-related securities, such as gold ETFs. These funds are

Basis Gold Fund Sovereign Gold Bonds What The gold mutual fund invests in physical gold or gold-related securities, such as gold ETFs. These funds are

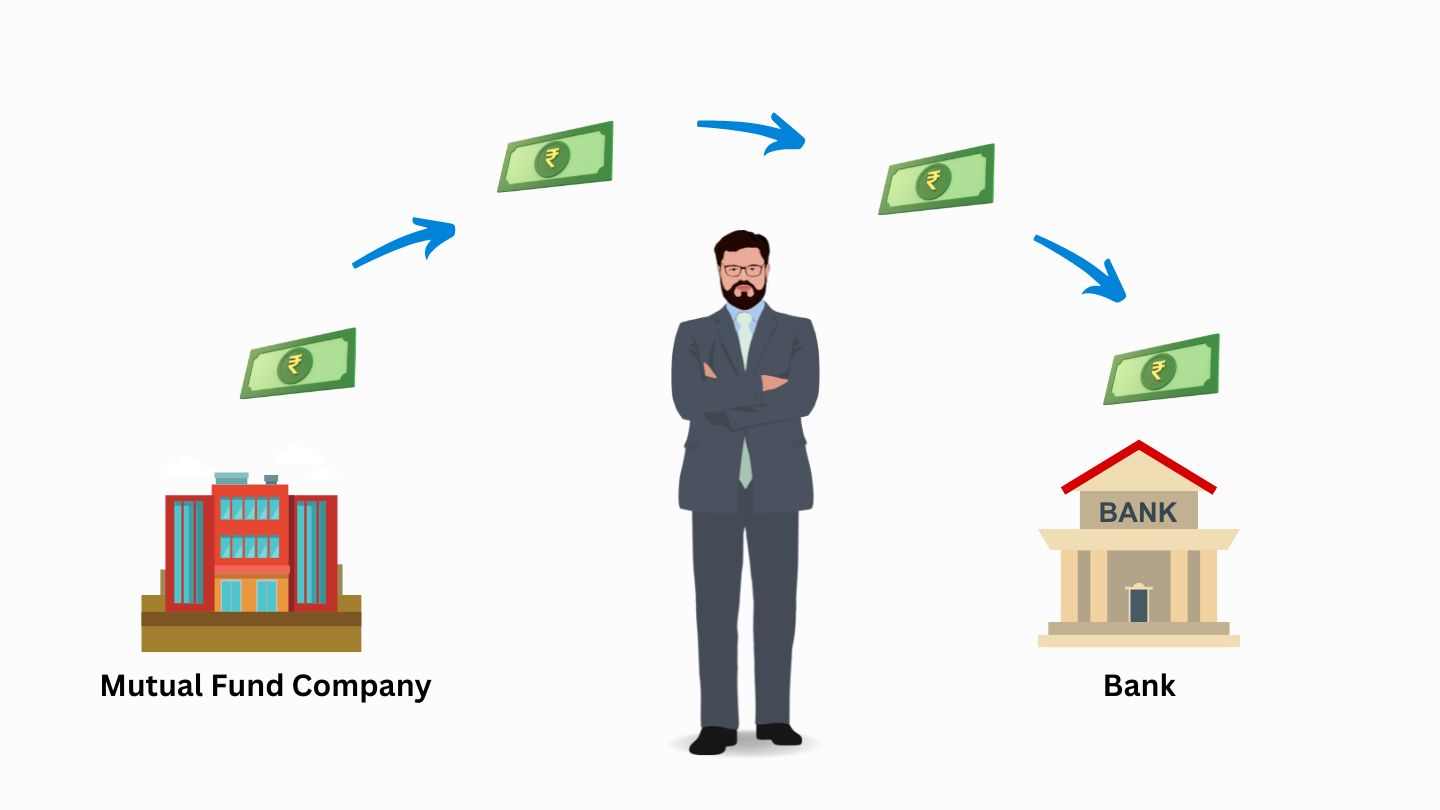

what is systematic withdrawal plan A Systematic Withdrawal Plan (SWP) allows investors to receive a regular stream of income from their mutual fund investments. This

Tax rules for both NRIs and Indian residents follow a similar structure. Capital Gain Equity Schemes Non-Equity Schemes Short-term Capital Gain 20% (less than 12 months)

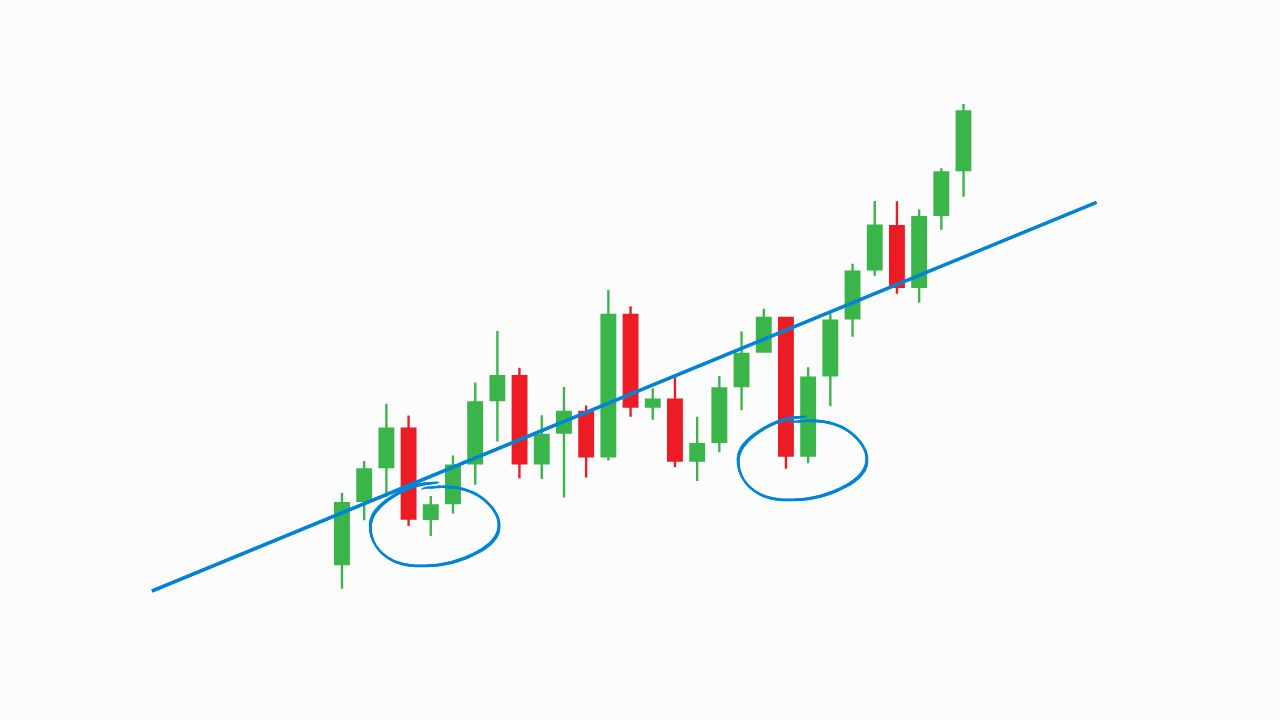

Regular SIPs Buying on Dips Monthly/quarterly fixed investments, irrespective of market conditions. Buy low, sell high based on market fluctuations. Doesn’t require constant market monitoring.

What are Debt Funds? Debt funds are mutual fund that primarily invest in fixed-income securities like government and corporate bonds etc. These funds aim to

Money Market Mutual Funds are a sort of scheme that generally invests in very short-duration instruments (normally a few hours or days). Money market is

NRIs based in the UAE can benefit from tax-free returns on mutual funds. Profits/gains can be redeemed without incurring taxes. If an individual holds a

A lot of parents want to invest in a minor’s name, but they don’t know how to do it. Minors are defined as individuals below

Here’s a step-by-step procedure to invest in mutual funds for NRIs: 1. Fulfill KYC Requirements: Submit Know Your Customer (KYC) documents. 2. Open an NRE

Mutual Fund investment for NRI, financial growth is a breeze with NRE and NRO accounts. Basis NRE NRO Full Form Non-Resident External Account Non-Resident Ordinary