Money Market Mutual Funds are a sort of scheme that generally invests in very short-duration instruments (normally a few hours or days).

Money market is a short-term instrument normally used by corporations to park surpluses for a few days or weeks.

- This market allows private investors, governments, and other small organizations to redeem funds in a short period of time. Normally, It offers better interest than a savings account or an FD.

- Investors need not worry about losing money in the money market as it is extremely safe.

- Money markets are often considered low-risk. These debt instruments also do not have an interest rate or duration risk.

Money Market Mutual Funds

- These are the mutual funds that invest in the money market. They are short-term mutual funds with lower risk. They are handled by professionals.

- Money market mutual funds invest in a diversified portfolio of short-term, high-quality securities.

- One of the distinguishing characteristics is great liquidity. On any business day, investors can simply purchase or sell shares in money market mutual funds at their current NAV. This makes them an ideal solution for those who require immediate access to their assets.

- Income generated by money market mutual funds is frequently free from state and municipal taxes, making them tax-efficient for certain investors. However, tax implications can differ, so investors should contact a tax professional.

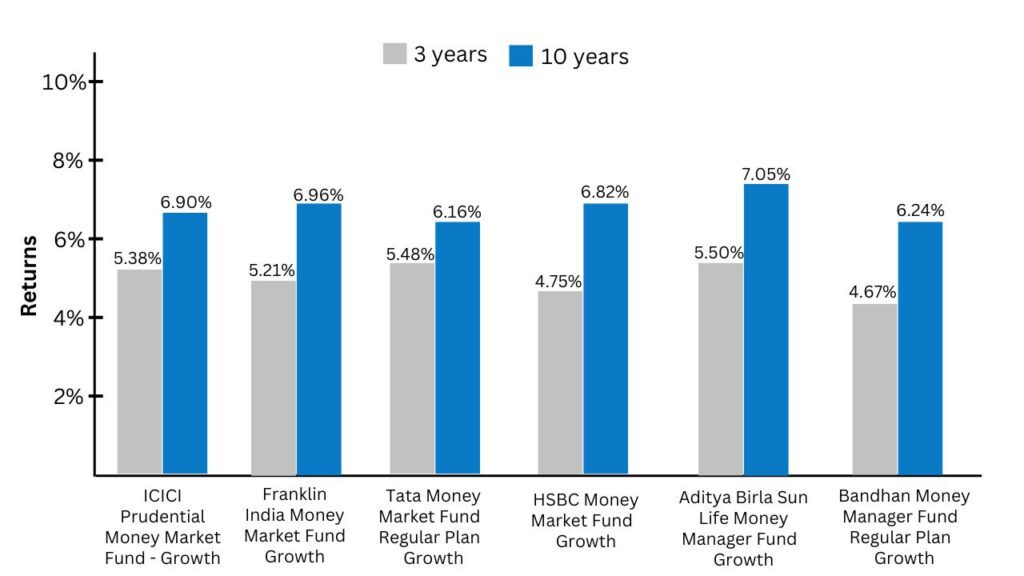

Returns of common Money market mutual funds

Before investing, one must check the returns and past performance of the funds.

MutualFundWala assists you in investing in the best money market mutual funds.

Money Market Mutual Funds offer safety and liquidity for short-term investments. At MutualFundWala, we can help you understand their benefits and how they fit into your strategy.