what is systematic withdrawal plan

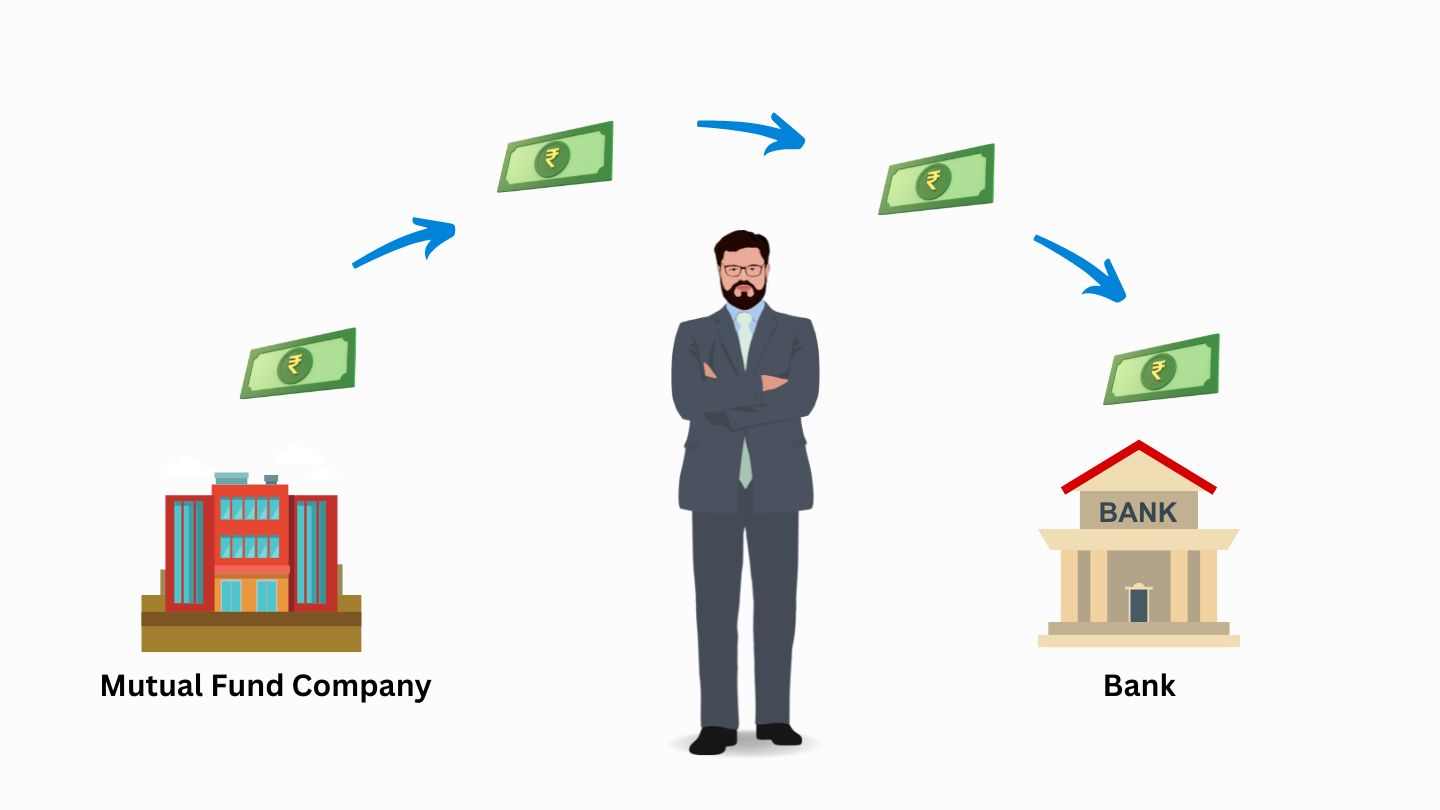

A Systematic Withdrawal Plan (SWP) allows investors to receive a regular stream of income from their mutual fund investments.

This approach serves as an effective pension (or a regular cash flow) generating strategy.

How does a Systematic Withdrawal Plan work?

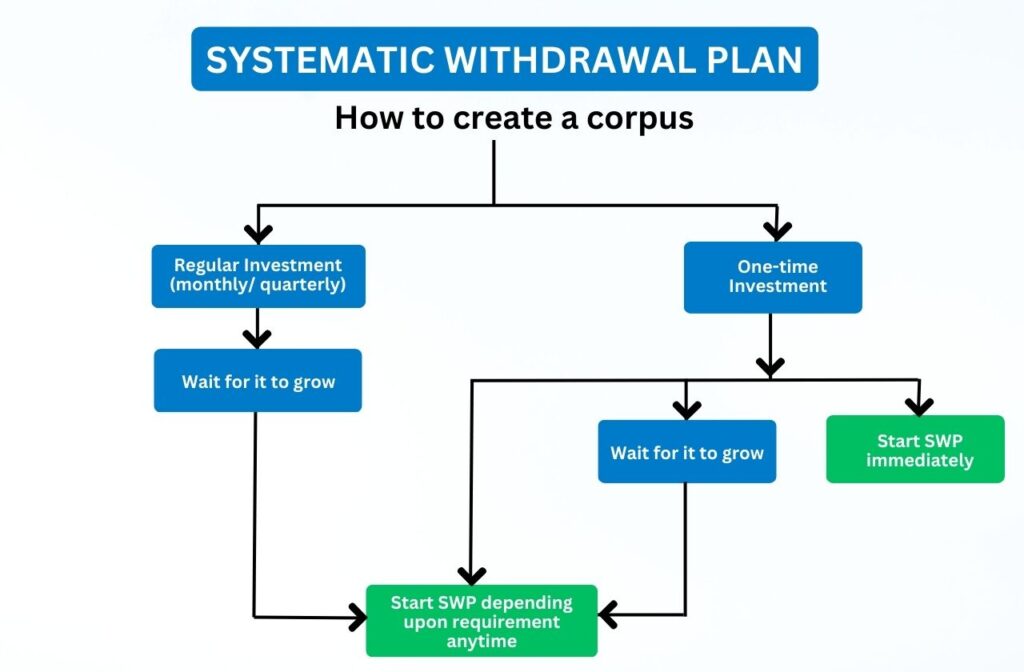

Consider an investor contributing Rs 1,00,000 annually for the next two decades with an assumed 12% average return.

By the end of the 20th year, the total corpus would be approximately 80.7 lakhs. Opting for a systematic withdrawal of Rs 50,000 allows for a decent corpus lasting at least 10-15 years. And the reserve also grows in value. Additionally, choosing schemes with consistent dividends could extend the duration to 15-20 years.

निष्कर्ष

A Systematic Withdrawal Plan (SWP) can provide a structured way to access your investments while maintaining portfolio growth.

At MutualFundWala, we help you understand how SWPs work and how they can be integrated into your financial strategy. If you’re interested in setting up an SWP or need expert advice on managing withdrawals effectively, contact MutualFundWala today. Our team is here to offer personalized support and ensure your investment strategy meets your financial needs seamlessly.